Do Rollovers Count As Income . Weigh the pros and cons. It can, however, affect your ability to make a. learn how to roll over your ira and the rules you must follow when you're transferring this type of retirement account. The question of whether ira distributions are considered income depends on why. the good news is that rolling money from a 401 (k) into an ira does not count against your annual contribution limit. the short answer is: under the basic rollover rule, you don't have to include in your gross income any amount distributed to you from an ira if you. 401(k) withdrawals count as income and must be reported to the internal revenue service (irs). The only cautions here are the ira contribution limits, and — if you chose a roth ira for your rollover — your.

from www.ameritas.com

The question of whether ira distributions are considered income depends on why. Weigh the pros and cons. the good news is that rolling money from a 401 (k) into an ira does not count against your annual contribution limit. under the basic rollover rule, you don't have to include in your gross income any amount distributed to you from an ira if you. the short answer is: It can, however, affect your ability to make a. 401(k) withdrawals count as income and must be reported to the internal revenue service (irs). The only cautions here are the ira contribution limits, and — if you chose a roth ira for your rollover — your. learn how to roll over your ira and the rules you must follow when you're transferring this type of retirement account.

401(k) Rollover Rules Ameritas

Do Rollovers Count As Income the short answer is: It can, however, affect your ability to make a. under the basic rollover rule, you don't have to include in your gross income any amount distributed to you from an ira if you. Weigh the pros and cons. the good news is that rolling money from a 401 (k) into an ira does not count against your annual contribution limit. learn how to roll over your ira and the rules you must follow when you're transferring this type of retirement account. The only cautions here are the ira contribution limits, and — if you chose a roth ira for your rollover — your. the short answer is: 401(k) withdrawals count as income and must be reported to the internal revenue service (irs). The question of whether ira distributions are considered income depends on why.

From www.youtube.com

💰 Nov W3 Variable Expenses, Rollover & BONUS Aus Cash Stuffer Do Rollovers Count As Income Weigh the pros and cons. 401(k) withdrawals count as income and must be reported to the internal revenue service (irs). learn how to roll over your ira and the rules you must follow when you're transferring this type of retirement account. the short answer is: under the basic rollover rule, you don't have to include in. Do Rollovers Count As Income.

From inflationprotection.org

401k rollover process explained Inflation Protection Do Rollovers Count As Income the short answer is: under the basic rollover rule, you don't have to include in your gross income any amount distributed to you from an ira if you. 401(k) withdrawals count as income and must be reported to the internal revenue service (irs). It can, however, affect your ability to make a. The only cautions here are. Do Rollovers Count As Income.

From thefinanceboost.com

Betterment Rollover 401k What is it and How does 401k Rollover Work? Do Rollovers Count As Income learn how to roll over your ira and the rules you must follow when you're transferring this type of retirement account. The only cautions here are the ira contribution limits, and — if you chose a roth ira for your rollover — your. the short answer is: It can, however, affect your ability to make a. under. Do Rollovers Count As Income.

From www.msoptionstrategy.com

The Definitive Guide To 401K Rollover Options Microsoft Layoff Resource Do Rollovers Count As Income Weigh the pros and cons. under the basic rollover rule, you don't have to include in your gross income any amount distributed to you from an ira if you. It can, however, affect your ability to make a. the good news is that rolling money from a 401 (k) into an ira does not count against your annual. Do Rollovers Count As Income.

From support.os4ed.com

How does the Rollover functionality work OS4ED Do Rollovers Count As Income It can, however, affect your ability to make a. the short answer is: learn how to roll over your ira and the rules you must follow when you're transferring this type of retirement account. Weigh the pros and cons. under the basic rollover rule, you don't have to include in your gross income any amount distributed to. Do Rollovers Count As Income.

From wrennefinancial.com

The True Cost Of The "NoFee" 401k Rollover Wrenne Financial Planning Do Rollovers Count As Income the short answer is: Weigh the pros and cons. It can, however, affect your ability to make a. 401(k) withdrawals count as income and must be reported to the internal revenue service (irs). The question of whether ira distributions are considered income depends on why. the good news is that rolling money from a 401 (k) into. Do Rollovers Count As Income.

From www.snideradvisors.com

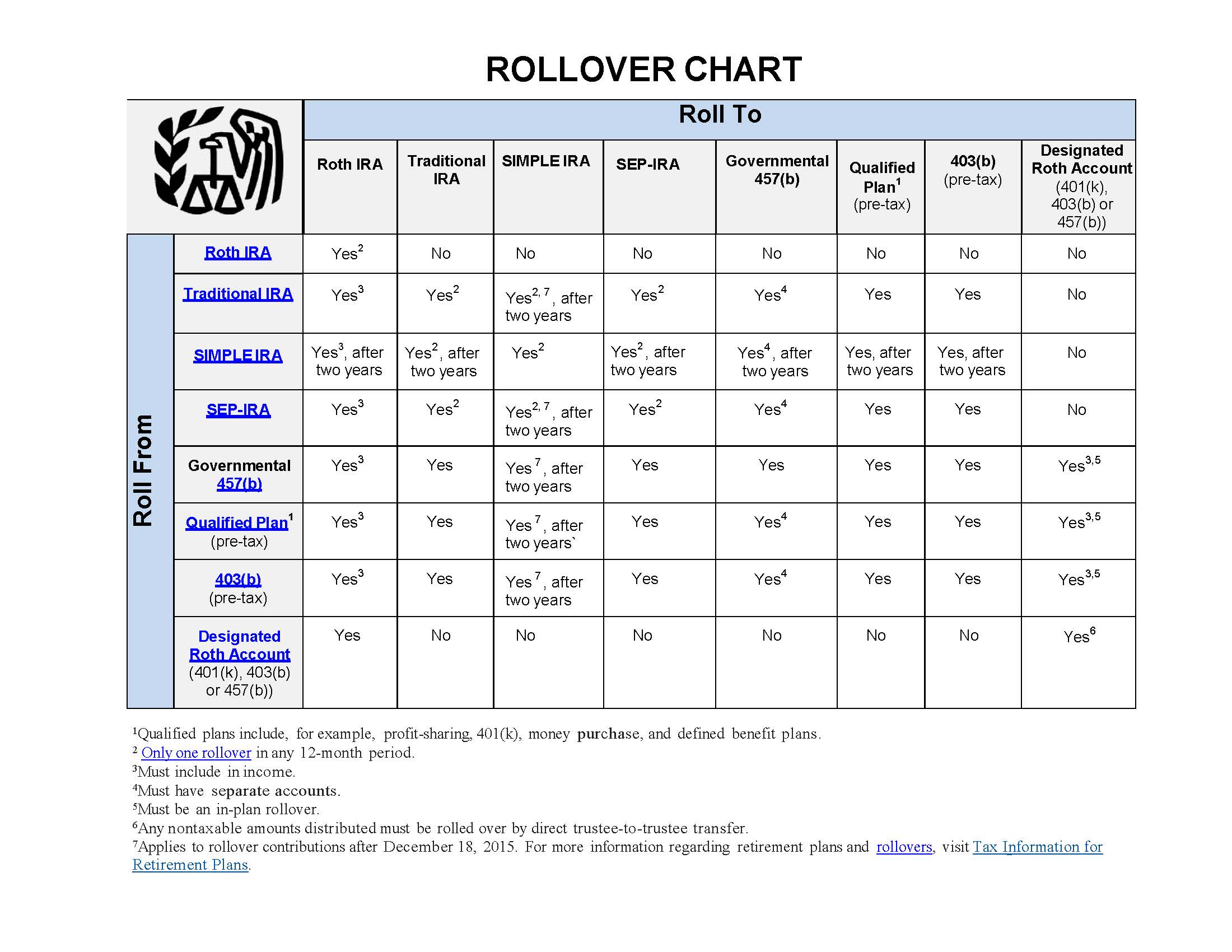

irsrolloverchart Snider Advisors Do Rollovers Count As Income The only cautions here are the ira contribution limits, and — if you chose a roth ira for your rollover — your. Weigh the pros and cons. the short answer is: the good news is that rolling money from a 401 (k) into an ira does not count against your annual contribution limit. The question of whether ira. Do Rollovers Count As Income.

From goldalliedtrust.com

IRA Rollover Chart Where Can You Roll Over Your Retirement Account Do Rollovers Count As Income under the basic rollover rule, you don't have to include in your gross income any amount distributed to you from an ira if you. Weigh the pros and cons. 401(k) withdrawals count as income and must be reported to the internal revenue service (irs). The only cautions here are the ira contribution limits, and — if you chose. Do Rollovers Count As Income.

From www.xtb.com

Everything You Need to Know About Rollovers! XTB Do Rollovers Count As Income the short answer is: It can, however, affect your ability to make a. under the basic rollover rule, you don't have to include in your gross income any amount distributed to you from an ira if you. The only cautions here are the ira contribution limits, and — if you chose a roth ira for your rollover —. Do Rollovers Count As Income.

From ira123.com

Learn the Rules of IRA Rollover & Transfer of Funds Do Rollovers Count As Income under the basic rollover rule, you don't have to include in your gross income any amount distributed to you from an ira if you. 401(k) withdrawals count as income and must be reported to the internal revenue service (irs). the short answer is: The only cautions here are the ira contribution limits, and — if you chose. Do Rollovers Count As Income.

From money.com

IRA Rollovers Why What You Do With Your 401k Is Important Time Do Rollovers Count As Income the good news is that rolling money from a 401 (k) into an ira does not count against your annual contribution limit. Weigh the pros and cons. learn how to roll over your ira and the rules you must follow when you're transferring this type of retirement account. The question of whether ira distributions are considered income depends. Do Rollovers Count As Income.

From www.retirementplanblog.com

IRS issues updated Rollover Chart The Retirement Plan Blog Do Rollovers Count As Income under the basic rollover rule, you don't have to include in your gross income any amount distributed to you from an ira if you. learn how to roll over your ira and the rules you must follow when you're transferring this type of retirement account. the good news is that rolling money from a 401 (k) into. Do Rollovers Count As Income.

From help.monarchmoney.com

Rollover budget feature Help Monarch Money Do Rollovers Count As Income learn how to roll over your ira and the rules you must follow when you're transferring this type of retirement account. It can, however, affect your ability to make a. the good news is that rolling money from a 401 (k) into an ira does not count against your annual contribution limit. under the basic rollover rule,. Do Rollovers Count As Income.

From us.etrade.com

Understanding IRA Rollovers Learn more Do Rollovers Count As Income It can, however, affect your ability to make a. the good news is that rolling money from a 401 (k) into an ira does not count against your annual contribution limit. under the basic rollover rule, you don't have to include in your gross income any amount distributed to you from an ira if you. The question of. Do Rollovers Count As Income.

From www.aaii.com

IRA Rollover Chart Rules Regarding Rollovers and Conversions AAII Do Rollovers Count As Income under the basic rollover rule, you don't have to include in your gross income any amount distributed to you from an ira if you. Weigh the pros and cons. the good news is that rolling money from a 401 (k) into an ira does not count against your annual contribution limit. learn how to roll over your. Do Rollovers Count As Income.

From www.ameritas.com

401(k) Rollover Rules Ameritas Do Rollovers Count As Income The only cautions here are the ira contribution limits, and — if you chose a roth ira for your rollover — your. the good news is that rolling money from a 401 (k) into an ira does not count against your annual contribution limit. It can, however, affect your ability to make a. Weigh the pros and cons. The. Do Rollovers Count As Income.

From kb.erosupport.com

How to Enter Pension And IRA Rollovers Do Rollovers Count As Income the good news is that rolling money from a 401 (k) into an ira does not count against your annual contribution limit. The question of whether ira distributions are considered income depends on why. 401(k) withdrawals count as income and must be reported to the internal revenue service (irs). learn how to roll over your ira and. Do Rollovers Count As Income.

From slideplayer.com

ALR832 Rollover Strategies and IRA Distribution Rules ALR832PPT. ppt Do Rollovers Count As Income under the basic rollover rule, you don't have to include in your gross income any amount distributed to you from an ira if you. 401(k) withdrawals count as income and must be reported to the internal revenue service (irs). The only cautions here are the ira contribution limits, and — if you chose a roth ira for your. Do Rollovers Count As Income.